Are you a non-resident in Spain? Do you own a property in this country?

Then you are subject to:

- The Spanish property taxes for non-residents (modelo 210)

- Real State Tax (IBI)

Índice de contenidos

Rental income taxation when a non-resident rents to an individual in Spain.

What does it need to be declared?

- Income

- Expenses

- Benefit

- Tax Rate (19% for EU and 24% for the rest)

The form to present to the tax authorities (Hacienda) is known as Model 210 “Non-Resident Income Tax”

Grouping period:

- Quarterly, in the case of self-assessments with amounts payable

- Annually, in the case of zero-quota self-assessments or with amounts to be refunded

How can I submit the rental tax returns?

- On paper by printing the PDF form available on the Tax Agency’s website and delivered to an associated bank

- Online

What is the deadline for submissions?

- Amounts payable; the first twenty calendar days of the months of January, April, July and October.

- Zero quota result: 1st -20th January of the following year

- Amounts to be refunded: from the 1st of February of the following year

Expenses

If you are EU resident, and you are renting your property as a main residence to your tenant, then you can deduct the following expenses:

Generic expenses to be included:

- Reparations

- Mortgage interest

- Management

- Middlemen commissions

- Community fees

- Real State tax (IBI)

- Home insurance

- Any other cost related (such as waste management if you are paying for this)

This is just for EU residents.

Can I deduct the furniture?

Yes, if you keep the related invoices you can deduct a 10% of this costs as amortization concept. Remember just for EU residents.

Is there any else to be deducted?

Yes! If you are EU resident you should deduct a 3% of the value of the home according to the registered value or the purchase costs (without taxes), whichever is higher.

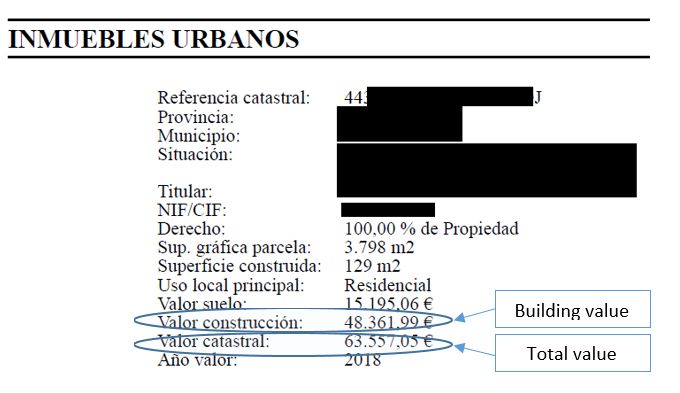

Typically the purchase cost is higher. Remember that you can deduct the value of the building apartment, but not the land value. To know these figures you must consult the Land Registry (Catastro).

In this example, we will calculate the percentage that construction represents:

48.361,99€ / 63.557, 05 = 76,09% (Building value / Total value)

So if we bought this apartment by 200.000€, and we paid to the solicitor 6.500€ (this does not include taxes), we could deduct:

3% x 76,09% x (200.000 + 6.500) = 4.713,91€

I have a property but is not rented. What’s going on then?

If this is your case then you must pay off the increase of the property value, also known as capital gains tax. It is not directly related to the market prices, but based on the assumptions taken by the local Authorities.

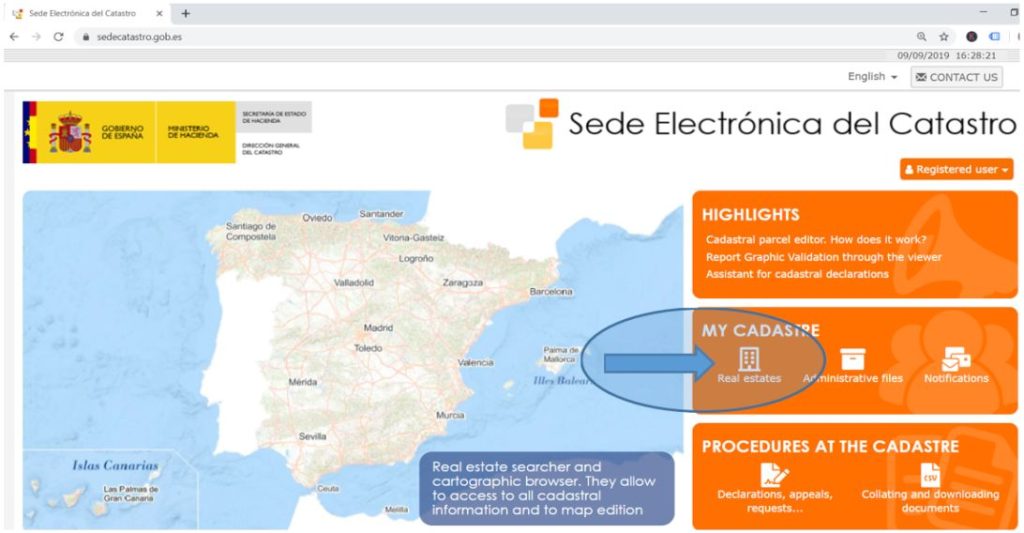

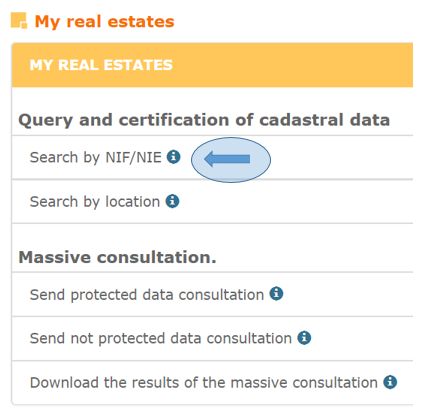

Revised value and Cadastre access

So if the prize was indexed in the last 10 years then the tax is 1.1% of the registered value. Otherwise it is 2%.

So if you bought a new property that has less than 10 years, the 1.1% applies. If your property is older you must check the year of the latest revision. See below.

You can find the registered value in the local Authority receipt (IBI : Impuesto de bienes inmuebles), or in the already mentioned Land Registry (Catastro).

Tax rates

This concept is taxed at 19% for the EU residents, Island and Norway and 24% for the rest of the world.

So, according to our last example, with a 2018 revised price, the calculation would be as follows:

Tax base: 63.557,05×1.1% = 699,13€

Modelo 210 result: 699,13€ x19% = 132,84€

Calendar of submissions

In this case the period is Annual.

The submission must be the first twenty (20) calendar days of the month of January of the following year.

Double taxation agreements with Spain

Find the double taxation agreements in this link of the Agencia Tributaria (Revenues).

See the original article in Spanish.

Note: The content of this article is just a personal opinion. This post does not represent any investment, legal or tax advice. This blog and the author if this article are not responsible for the use made by the reader of this information.